Forex day trading strategies can be the key to unlocking significant profit potential in the exciting currency markets. Day traders aim to capitalize on small price movements throughout the day, and deploying well-thought-out strategies is essential for success. By understanding various approaches and employing disciplined risk management practices, traders can increase their chances of achieving their financial goals. For those interested in the forex market, finding reliable partners is essential; check out the forex day trading strategies Best Saudi Brokers to enhance your trading experience.

Understanding Forex Day Trading

Forex day trading refers to the practice of buying and selling currency pairs within the same trading day. Day traders typically close all positions before the market closes, avoiding overnight risks. The forex market operates 24 hours a day, allowing traders to take advantage of various price movements that occur across different time zones. This fast-paced environment requires a keen understanding of market dynamics, technical analysis skills, and the ability to make quick decisions.

Key Concepts in Day Trading

Before delving into specific strategies, it’s essential to familiarize yourself with several key concepts that underpin forex day trading:

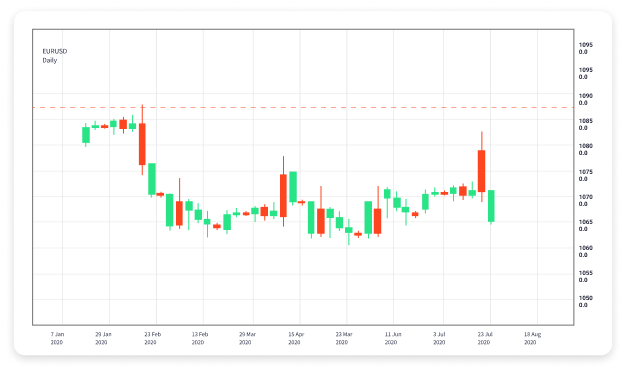

- Liquidity: High liquidity ensures that traders can buy and sell currencies without significant price fluctuations. Major currency pairs, such as EUR/USD and USD/JPY, are generally more liquid.

- Volatility: Volatility refers to the degree of variation in a trading price series over time. Day traders often seek volatile assets, as these conditions can lead to significant price movements and profitable opportunities.

- Technical Analysis: Utilizing charts and indicators to identify potential trading opportunities is crucial for day traders. Technical analysis involves analyzing past price movements to predict future trends.

Popular Forex Day Trading Strategies

Scalping

Scalping is a popular day trading strategy that focuses on making small profits on numerous trades throughout the day. Scalpers hold positions for a very short duration, often just a few seconds to minutes. The idea is to take advantage of minor price changes in high liquidity environments. Successful scalpers often use technical indicators such as Bollinger Bands and the Moving Average Convergence Divergence (MACD) to find entry and exit points.

Momentum Trading

Momentum trading involves identifying assets that are moving significantly in one direction and riding that trend. Day traders using momentum strategies will look for stocks or currency pairs that have shown significant movement and capitalizing on that movement for quick profits. Technical indicators such as Relative Strength Index (RSI) and moving averages are commonly used to help identify momentum.

Breakout Trading

Breakout trading focuses on identifying significant price levels or patterns that could lead to heightened volatility. Traders look for breakouts from key support and resistance levels. A breakout can signal a potential trade, with the expectation that the price will continue in the direction of the breakout. Day traders often set stop-loss orders to protect against sudden price reversals.

Range Trading

Range trading is based on the concept that prices often move within defined support and resistance levels over a certain period. In this strategy, traders identify a range, buy at the support level, and sell at the resistance level. While range trading can be effective, it’s essential to be cautious during periods of high volatility, as breakouts can lead to losses if not managed carefully.

Setting Up for Day Trading

To successfully engage in forex day trading, you need to set up a solid foundation. Here are some practical steps to consider:

- Choose the Right Broker: Selecting a broker that suits your trading style is crucial. Look for brokers that offer low spreads, fast execution, and a robust trading platform.

- Create a Trading Plan: A well-defined trading plan should outline your strategies, risk management techniques, and specific goals.

- Practice with a Demo Account: Before diving into real trading, utilize a demo account to practice your strategies without risking actual money.

- Stay Informed: Keep up with economic news and events that could affect currency markets. Economic indicators, central bank announcements, and geopolitical events can all impact price movements.

Effective Risk Management

Risk management is fundamental to successful day trading. Even the best traders experience losses; thus, protecting your capital is essential. Here are a few key risk management strategies:

- Set Stop-Loss Orders: Implement stop-loss orders to limit potential losses on trades. A well-placed stop-loss can protect against significant downturns.

- Risk a Small Percentage of Your Capital: Aim to risk no more than 1-2% of your trading capital on any single trade. This strategy helps to preserve your trading account during losing streaks.

- Diversify Your Trades: Avoid putting all your capital into one trade. By diversifying, you can mitigate risks and better manage your overall portfolio.

Conclusion

Forex day trading can be an exciting and potentially lucrative pursuit if approached with the right strategies and mindset. By understanding various trading techniques, honing your skills in technical analysis, and employing strict risk management practices, you can improve your chances of success in the forex market. As you venture into day trading, continue to educate yourself and adapt your strategies to changing market conditions to remain competitive and achieve your financial objectives.

Leave A Comment