Forex trading, often referred to as foreign exchange trading, is a dynamic and exciting market where currencies are exchanged and traded. In this article, we will delve into the various aspects of forex trading, offering insights, strategies, and tips to help you navigate this complex world. Before we proceed, you can explore more about trading by visiting forex trading acev.io.

Understanding Forex Trading

The foreign exchange market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. It operates 24 hours a day, five days a week, making it accessible for traders around the globe. Unlike traditional stock markets, the forex market is decentralized, meaning there is no single physical location where transactions take place. Instead, trading occurs electronically through a network of banks, brokers, and financial institutions.

Key Players in the Forex Market

Several key players contribute to the forex market’s dynamics. These include:

- Central Banks: National banks that influence the country’s currency value through monetary policy and interest rates.

- Commercial Banks: Financial institutions that facilitate international trade and investments, providing liquidity to the market.

- Institutional Investors: Hedge funds, pension funds, and other large entities that trade significant volumes of currency.

- Retail Traders: Individual investors who participate in the forex market, using brokers to execute trades.

How Forex Trading Works

In forex trading, currencies are quoted in pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is the base currency, while the second is the quote currency. The exchange rate tells you how much of the quote currency is needed to purchase one unit of the base currency. For instance, if the EUR/USD pair is quoted at 1.10, it means 1 Euro can be exchanged for 1.10 US Dollars.

Types of Forex Analysis

To make informed trading decisions, forex traders rely on different types of analysis:

- Fundamental Analysis: This involves evaluating the economic indicators, interest rates, and geopolitical events that can impact currency values. Traders look for data releases such as GDP reports, employment statistics, and central bank announcements.

- Technical Analysis: This focuses on analyzing historical price movements and using chart patterns, indicators, and other tools to predict future price trends. Traders often rely on support and resistance levels, moving averages, and oscillators.

- Sentiment Analysis: Understanding market sentiment is crucial for forex traders. This involves gauging the overall mood of the market—whether traders are feeling bullish (optimistic) or bearish (pessimistic) about a particular currency pair.

Developing a Forex Trading Strategy

A successful forex trader needs a well-defined trading strategy. Here’s how you can develop one:

- Set Clear Goals: Determine what you want to achieve with your trading. Are you looking for a steady income, long-term growth, or short-term gains?

- Choose a Trading Style: Your trading style depends on your personality and lifestyle. Common styles include day trading, swing trading, and scalping.

- Risk Management: Establish how much capital you are willing to risk on each trade. Use stop-loss orders to minimize potential losses and protect your trading account.

- Continuous Learning: The forex market is constantly changing. Stay updated on market trends, new trading strategies, and economic developments to enhance your trading skills.

Common Mistakes to Avoid

Even experienced traders can fall into traps that can undermine their success. Here are some common mistakes to avoid:

- Lack of a Trading Plan: Trading without a clear plan can lead to impulsive decisions and emotional trading. Develop a comprehensive trading plan and stick to it.

- Overleveraging: While leverage can amplify profits, it can also amplify losses. Use leverage wisely and avoid risking more than you can afford to lose.

- Neglecting Emotional Control: Trading is often driven by emotions such as fear and greed. Maintain emotional discipline and avoid making decisions based on short-term market fluctuations.

- Ignoring Economic News: Economic indicators significantly impact currency values. Stay informed about relevant news and events that could affect your trades.

The Importance of Staying Informed

Successful forex trading requires staying informed about global economic trends and geopolitical events. Regularly following financial news, market analysis, and expert opinions can help you make better trading decisions. There are numerous resources available, including economic calendars, news websites, and forex forums. Engaging with other traders and participating in discussions can also provide valuable insights.

Tools and Platforms for Forex Trading

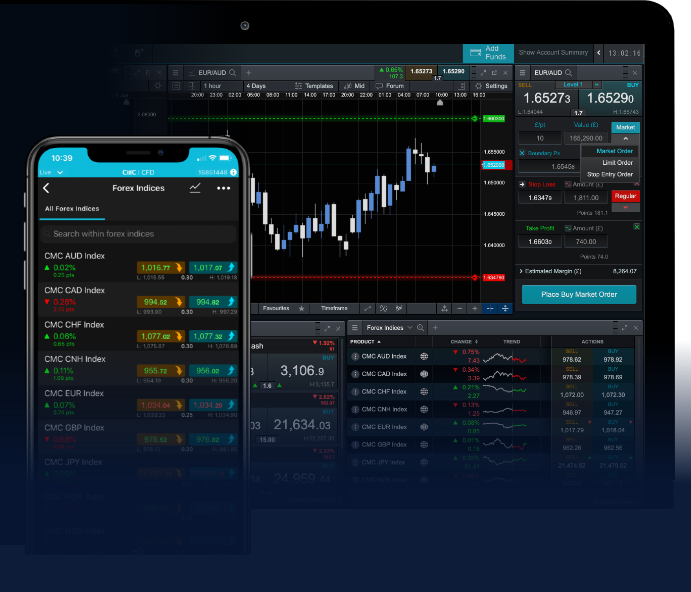

To trade forex effectively, you need the right tools and platforms. Here are some essential tools:

- Trading Platform: Choose a reliable trading platform that offers a user-friendly interface, charts, and technical analysis tools. Popular platforms include MetaTrader 4 and 5, cTrader, and TradingView.

- Demo Account: Before risking real money, practice trading with a demo account to familiarize yourself with the platform and test your strategies.

- Economic Calendar: An economic calendar provides information on upcoming economic events and data releases that could impact the forex market.

- Social Trading Platforms: Consider joining social trading platforms that allow you to follow and replicate the trades of successful traders.

Conclusion

Forex trading presents an incredible opportunity for those willing to learn, practice, and develop their skills. By understanding the fundamentals, implementing sound strategies, and avoiding common mistakes, you can navigate the forex market with confidence. Stay informed, be disciplined, and never stop learning in your pursuit of forex trading success.

Leave A Comment